Canada’s finance department interested in China; China-middle powers relations at COP27; Chip-facility sales blocked by Berlin

What we learned from our information request to the Canadian government

Dear China watchers, welcome to another weekly roundup by yours truly.

The Canadian Parliament is taking the week off so, once again, we’re only publishing one edition—but this time, it’s the world roundup. We’ve also noticed that many of you prefer reading the newsletter on Sunday hence the change in publication time. Please let us know if that’s a good idea! And as always, thank you for your continued support.

We finally heard back from one of our many information requests to the Canadian government, so we’re introducing a new section this week, Sneak Peek, featuring some original reporting based on the documents we received. As some of our readers are seasoned international politics watchers, we think this might interest you.

If you like what we do here, please consider sharing with a few of your colleagues to support our work.

Sneak Peek

(What we learned about the Canadian government from our information and privacy requests)

A June meeting between a Canadian government official and a high-profile China expert.

According to a briefing note we obtained from the Department of Finance, Michael Sabia, the department’s deputy minister, scheduled a meeting with China expert Raymond Yeung in the summer.

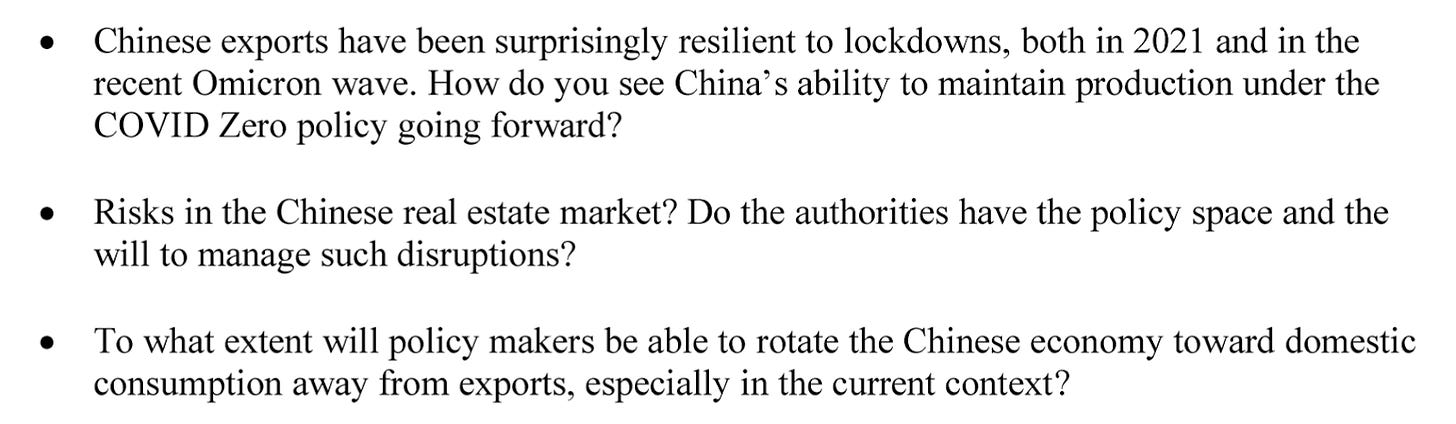

A few things that caught our attention:

Yeung is the China Chief Economist for the Australia and New Zealand Banking Group (ANZ) according to his LinkedIn profile. He received education from two prominent Canadian universities before spending over a decade studying China’s economy. Yeung has been frequently quoted in the media. Here’s a clip of him with Bloomberg.

The meeting was suggested by Daniel Koldyk, counsellor and chief representative for the Department of Finance at the Canadian embassy in Beijing. The focus of the meeting, it appears, is to explore the possibilities of continuing trade and cooperation with the PRC in some fields.

Most of the questions suggested to the deputy minister are around the stability of the economy, especially in relation to export and trade.

A couple of takeaways:

As some of you may know, CPP Investments, Canada’s largest public pension fund, invests heavily in the China market (C$57.5 billion, or 11.5 per cent of its portfolio.) The stability of the Asian market has a significant bearing on Canada’s economy.

Sabia’s interest in understanding China’s trade outlook seems to go in line with Ottawa’s expected two-fold strategy towards the Asian superpower. (Scroll to the Canada section for more info.) The briefing note was prepared in June, about six months after the government first announced it was developing an Indo-Pacific strategy. Also in June, Foreign Minister Melanie Joly established an advisory committee of retired politicians, researchers and businessmen to get their recommendations on the strategy.

Here’s what we are looking at this week from the middle powers:

A semiconductor giant from the Netherlands attends a China trade expo.

Chinese authorities scrap an E.U. diplomat’s appearance at the same event.

Berlin makes a U-turn on the sale of a semiconductor facility.

Australian police downplay China’s overseas service stations while the defence department orders a policy review on ex-military personnel.

China and Arab Gulf states are putting the final touches on their free trade agreement.

Saudi Arabia signs a deal with a Chinese private oil refinery.

China says it supports developing countries demanding compensation for loss and damage caused by climate change, but not financially.

Business

Semiconductor ban; China-GCC FTA; trade

Netherlands

A semiconductor giant from the Netherlands attends China trade expo amid U.S. sanctions

ASML, one of the world's most important semiconductor tool makers, was featured on China Daily Thursday for its attendance at the fifth China International Import Expo. Shen Bo, senior vice-president of ASML and president of ASML China was quoted saying the company supports the development of the semiconductor industry through “open innovation.”. “China will continue to play an integral role in driving the development of a highly collaborative global semiconductor industry,” ASML said in a statement to Chinese state media.

Veldhoven-based ASML is an industry giant and critical in global chip supply chains. It is the only firm in the world that can produce extreme ultraviolet machines (EUVs) and lithography machines, making chips smaller and more powerful. The industry giant has remained relatively unfazed by the U.S. chip export ban on China.The latest restrictions don’t prevent the company from exporting less advanced deep ultraviolet machines (DUVs) to the Asian superpower. Yes, even for a sweeping ban like Biden’s, there are limits—export controls on tech usually require cooperation with more than one state to be truly effective. (Although the company no longer sells its most advanced EUVs to China.)

The U.S. has been trying to convince the Dutch government to block the export of less advanced DUVs to China. Last week, Bloomberg reported that senior U.S. officials were travelling to the Netherlands for further talks.

Mum’s the word for Dutch Minister for Foreign Trade and Development Cooperation Liesje Schreinemacher, who refused to share details about conversations with the U.S. during a parliamentary discussion this week.

Germany

Berlin makes a U-turn on the Chinese takeover of a semiconductor facility

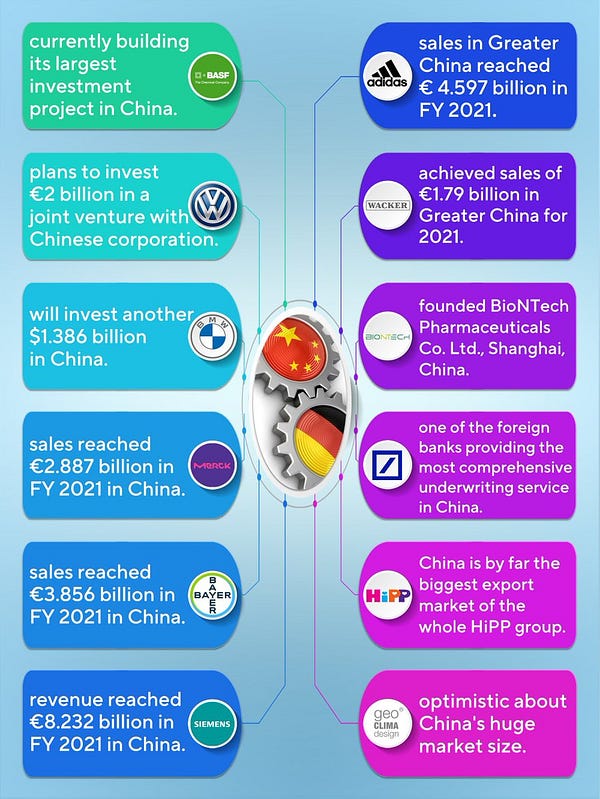

The German government blocked the sale of a chip factory owned by Dortmund-based company Elmos. The buyer was Silex, a competitor wholly-owned Swedish subsidiary of Chinese company Sai Microelectronics. The decision came a week after Chancellor Olaf Scholz’s visit to China with a high-level business delegation.

If you have been following us for a while, you must be familiar with Berlin’s dilemma over its relationship with Beijing. Last month, we highlighted Berlin’s compromise over a Chinese shipping firm’s investment in a major container terminal. Scholz went against six federal ministers (including the economy minister) to approve the deal.

This time, the decision wasn’t that smooth, either. Just a few weeks ago, media reports indicated that the German government was going to approve the takeover of Elmos against security advice.

The economy ministry, which was responsible for reviewing the deal, advised against the sale, according to an earlier report by Bloomberg.

It’s worth noting that the proposed takeover wasn’t financially significant and the technology involved apparently wasn’t new. Blocking the deal, however, signals how perturbed German politicians are about the national security threats posed by the PRC.

The government also reportedly voted against the proposed takeover of ERS Electronic GmbH, a small Bavaria-based firm that makes cooling systems for the chip industry.

By stopping the two sales, Germany has for now avoided making the same mistake as neighbouring Sweden. Silex, the Swedish company interested in Elmos, was acquired by Sai (previously known as NavTech) in 2017 without much fanfare. But the acquisition opened doors for China to advance its semiconductor industry. Read more about this fascinating story here.

Spotted

GCC

China and Arab Gulf states are putting the final touches on their free trade agreement; Saudi Arabia signs a deal with a Chinese “teapot”.

Zhang Yiming, PRC’s ambassador to the United Arab Emirates, said all sides of the free trade deal have agreed on most issues in an interview with the UAE’s state news agency WAM. Negotiations began in 2004 but have slowed down multiple times over the past 18 years.

The finalization of the agreement seems more promising than it was a couple of years ago as the internal conflicts in the Gulf have now been resolved. Despite the on-and-off talks, China managed to entrench itself as a major trading partner with many member states. Two of the region's most influential countries, Saudi Arabia and the UAE, have bolstered their cooperation with the PRC by signing several agreements since 2018, including a Sino-Saudi energy deal last month. The Asian superpower is now an essential player in the Gulf states’ hyped-up visions for economic development released a few years ago.

GCC oil producers have also been expanding relations in the Chinese refining market, most notably Saudi Aramco. Just last week, the state-owned producer signed a $735M deal with China’s teapot refinery ZPC.

But energy is not all there is to Gulf-China relations. The cooperation has expanded to other non-oil industries such as infrastructure investment, trade in goods and services, digital technology, and defence.

Note this fantastic analysis from the Atlantic Council in January: “A potential China-GCC FTA should remind US policymakers that for Beijing, Washington’s absence means opportunity — both in the Gulf and on the international stage at large.”

The bloc might also be counting on Beijing to play a mediating role with Iran after the continued pause on Washington-Tehran nuclear talks. The region’s geographical location and political alliances would put them at risk if tensions between Iran and the U.S. and Israel were to escalate into direct confrontations.

In any case, the China-GCC trade agreement could be a hot topic at the first-ever China-Arab summit in Saudi Arabia next month. Rumours of Chinese President Xi Jinping’s visit to the kingdom have been circulating since August—the latest was from a Wall Street Journal report claiming Xi would arrive before the end of the year. However, a Chinese Foreign Ministry spokesperson later denied knowledge of the reported visit.

Politics

Indo-Pacific; ex-pilots; police stations; E.U.-China relations

Canada

Ottawa teases its delayed Indo-Pacific strategy and Canadians don’t like China anymore.

On Tuesday, Canada’s foreign affairs department, Global Affairs, issued an unexpected media release inviting journalists to cover a teaser about the long-overdue Indo-Pacific strategy. Here’s a video of the full speech if you are curious.

It’s easy to get sucked into the publicity rhetoric and lose track of the effectiveness of the actual policy that has yet to be dropped. And if there’s anything we learned from following the China-Canada space, it’s to be extra cautious about the promises. We can expect a formal release of the Indo-Pacific strategy later this month, Joly said.

The timing of the briefing is sensitive as it sets the stage for three important meetings that Joly and Prime Minister Justin Trudeau will be attending starting next week—all in the Indo-Pacific: the Association of Southeast Asian Nations, the G-20 and the Asia-Pacific Economic Cooperation summits, two of which will be joined by the Chinese President Xi Jinping.

Like many other middle powers, Canada doesn’t have the most favourable public opinion towards China right now. A recent poll shows that eight out of 10 Canadians say China has a negative influence on world affairs. As we all know, public opinion will to some extent contribute to the government’s strategies.

E.U.

Chinese authorities scrap an E.U. diplomat’s appearance at a high-profile trade expo in Beijing

European Council President Charles Michel was set to deliver a speech through a pre-recorded video at the China International Import Expo in Shanghai. In the video, Michel would have called Russia’s invasion of Ukraine an “ illegal war” and said Europe has been over-dependent on Russian energy leading to a trade imbalance.

It’s not clear why the video was not shown but here are two speculations:

The speech could be seen as an insinuation of the bloc's toughening stance on China. The over-dependence on the PRC has been a subject of debate in Europe, especially Germany. E.U. diplomats told Reuters that the bloc seeks to balance trade relations with all nations, including China.

Michel was also set to demand that Beijing does more to end Russia’s war on Ukraine, something that China has been reluctant to do publicly. .

Michel’s spokesperson said they complained about the snub through official diplomatic channels. Xi and Michel are expected to meet at next week’s G20 Bali summit. (Awkward encounter alert!)

Australia

Police say China’s overseas service stations don’t worry them while the defence minister demands a policy review to ward off national security threats from Beijing.

Australia has made a couple of interesting moves in response to the recent high-profile interference operations by the PRC. On Monday, the Australian Federal Police (AFP) told a Senate estimate hearing (kinda like an accountability hearing) that it does not believe that Chinese overseas service police stations are currently maintaining a secretive "contact point" in Sydney.

China hawk James Paterson grilled AFP officers. Deputy Commissioner Ian McCartney told the committee that he did not have any concerns about the stations. "Is that because this was a declared presence, a cooperative arrangement with the AFP, or because you don't have concerns because you don't believe it's active?" asked Senator Paterson. "I don't believe it's active," the deputy commissioner responded.

Now a small update on Australia’s response to the media reports that Beijing had approached former military personnel to become trainers for the People’s Liberations Army. Australia’s defence minister said on Wednesday he had told the nation’s military to review policies and procedures that apply to former Defense personnel “particularly those who come into possession of our nation’s secrets,” said Minister Richard Marles.

The Australian Defense Department’s response is in stark contrast to its Canadian counterpart. As we reported last week, BGen Denis Boucher, Canada’s director general of defence security, claimed that the investigation falls under the purview of the Royal Canadian Mounted Police and the Department of Justice in response to questions from parliamentarians.

COP27

Climate financing; Africa; uranium mining

Chinese money off limits

China says it supports developing countries demanding compensation for loss and damage caused by climate change, but not financially.

The Chinese envoy to COP27, Xie Zhenhua, said Beijing has no obligation to help emerging economies cope with climate-linked disasters but is willing to “cooperate.” Although this could be interpreted as a promise to pay money, a spokesperson for the envoy later clarified that this wasn’t Xie’s intention.

This appears to go against the joint declaration that China released last year with 53 African nations, announcing their intention to strengthen cooperation in tackling climate change. The statement mentioned joining forces in “the field of climate investment and financing.”

Discussion of loss and damage compensation has intensified at this year’s conference, with developing countries putting increased pressure on the world’s richest nations.

Antigua and Barbuda, on behalf of the Association of Small Island States negotiating bloc, requested payments from India and China specifically. It’s the first time that the world’s third and first-biggest greenhouse gas emitters are mentioned in this context. The island nation’s Prime Minister Gaston Browne called out the two countries for being “major polluters,” who shouldn’t get a “free pass” and “must pay.”

China isn’t the only country averse to financially owning up for climate-damaging activities. Historically, rich economies including the U.S. and the E.U. nations have resisted steps that could assign legal liability or lead to compensation. States facing loss and damage get help from existing U.S. and international development banks, but the funding is not officially earmarked for that goal.

Xie claimed China has spent billions of yuan to fund climate initiatives in developing countries. A document uploaded to the COP27 website by BRI partner Uzbekistan indicates the Central Asian nation received more than $714M from Chinese financial institutions Eximbank and CSDB to fund activities including mitigation measures and developing green energy. China also contributes to the Asian Development Bank which provided Tashkent with $11.1M in grants.

Pakistan, another key BRI partner, has been very vocal about its demands for emergency funds at the summit. The cash-strapped country is struggling to recover from massive flooding that engulfed big parts of the country last summer and cost more than $30B in economic losses. Most recently, the PRC has agreed to give the fellow SCO member billions of dollars in debt relief Albeit, none of the funds was designated for climate projects.

Namibia is another African nation that caught our eye at the conference. Beijing has invested heavily in the country’s uranium mines through BRI, furthering the Chinese government’s nuclear power agenda. This week, Namibia said it secured $544M in climate finance from the Dutch government and European Investment Bank.

Thank you for reading. And have a good weekend.